Why Restaurants Resist Moving To 4-Week Periods & 13 Cycles Per Year (Instead of 12)

What are the common reasons that restaurants don’t use the 4-week cycle?

While there are many reasons to use the 4-week system operationally, the reason it’s not used usually comes from a disconnect between operations and the accountants.

Our mission at Trusted CFO Solutions is to help drive the performance of our clients’ businesses (i.e. especially restaurants, but retail and hospitality also). So, as part of our mission, we connect and unify operations and accounting. Here are the obstacles we face in our mission.

Answers To Why 4-Week Reporting Periods Are Not Used —

- Bank statements arrive monthly, not every four weeks. Our best practices are to record bank transactions on a daily basis and prepare reconciliations at any time without having to wait for a statement to arrive in the mail. Also, most banks will cut off your statement on the dates you request, just give them a schedule with your 4-week cut-off dates. Also, with electronic access, balances on important dates can easily be verified.

- Expenses like rent and utilities are paid once a month. The accountants can set up a schedule to expense 11/12ths of each monthly payment and place the remaining 1/12th into a prepaid account. Once a year, the balance in the prepaid accounts is expensed into period 13. We also use software that automatically does Prepaid Expense Automation in a separate module.

- Sales Taxes are paid monthly. Most states will allow you to pay sales taxes 13 times a year instead of 12 monthly payments. If not, a separate monthly sales tax payments schedule can be created.

- Most accounting software won’t accommodate a 13 period year. Update your accounting software to packages that have flexible reporting period capabilities. Our software can easily handle a 4-week period and also custom periods if needed.

The 4-week system is our best practice at Trusted CFO Solutions because it improves understanding of how your restaurant is actually performing. Our clients using this method would never consider going back to monthly financials.

It’s worth exploring the switch from calendar month end to 13 period years. We’re happy to play a role in that discovery. Simply contact us to get started.

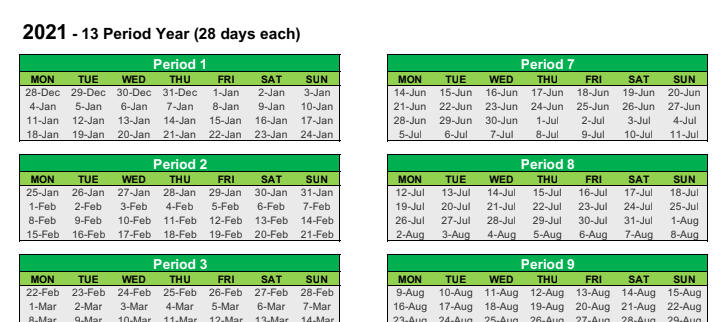

Fill Out The Following Form & Download A Complimentary 4-Week Printable PDF Schedule For Your Restaurant in 2022/2023

For 2022, we provide a 4 week 13-period calendar starting on Monday and one starting on Wednesday.

A 2023 PDF schedule starting on Monday is also available for download.

Tags

Grow Your Restaurant

With our Free Restaurant Success Series

Freely access our restaurant resource center filled with tools, videos, webinars, articles, infographics, and other helpful content to tackle your unique restaurant challenges and grow the business.

What are you waiting for?

Click the button below to learn more.

Related Content

Wrap-Up: Reimagine Your Month-End Close with Sage Intacct

Best Practices to Perfect Your Month-End Close With Sage Intacct

Decoding the Challenges of the Month-End Close

Fast-Track Your Financials: Techniques to Slash Your Month-End Close

Take Control of the Month-End Close: A Checklist for Success

Managing Your Accounts Payable: A Guide for Small Business Owners

© Trusted CFO Solutions.