Why Are A Restaurant’s Prime Costs So Important?

This is part of our Restaurant Success Series. Click here to access other articles.

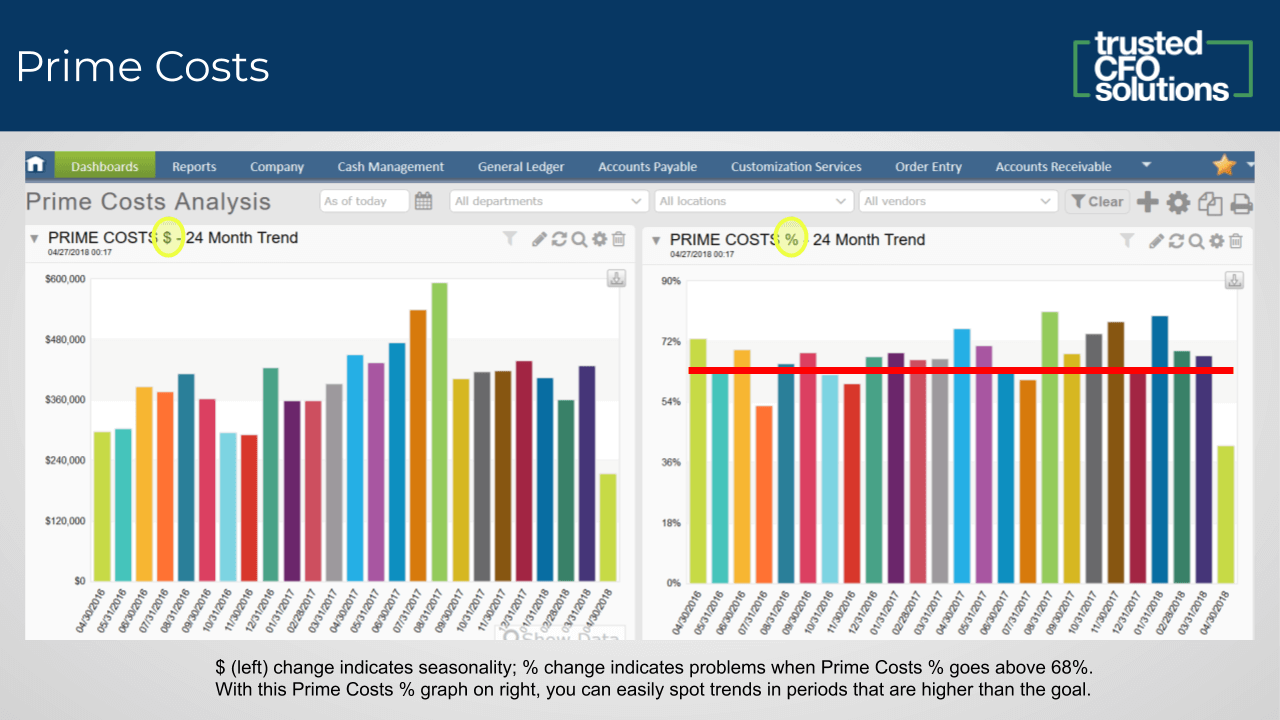

Our restaurant clients are getting a good handle on controlling food cost and labor, thanks to our Prime Costs Dashboard.

Prior to Trusted CFO Solutions, most only used QuickBooks and only recorded things once a month – after month-end. Today, however, they can review their numbers by the day and also by the week.

The Prime Costs Dashboard is opening eyes. Not only are we educating them on the power of monitoring costs weekly, but the benefit is that they are able to control it before it’s too late.

With the old way of doing things, our clients weren’t paying attention until the end of the month once the bank account was reconciled. By that time, they couldn’t rectify anything that happened three weeks ago.

Watching Prime Costs more often is one of the best things a restaurant can do to improve its performance.

For some of our clients, food costs had previously run at about 42%. That is a little too high, especially for certain types of restaurants. Once we started scrutinizing the weekly numbers, food costs went down to around 36%. For a $2,000,000 annual sales restaurant, that’s $120,000 back in their pocket.

The second area of Prime Costs scrutiny was the restaurants’ labor costs that usually run high as well. Several restaurant clients were seeing numbers as high as 30% for labor costs. Now with weekly scrutiny, those percentages have dropped to ranges of 22-25%. The annual savings there can oftentimes be more than the amount spent on an outsourced accounting department per year.

A key part of the changes involved a training component during our routine weekly calls and period-end meetings. Logging into the Prime Costs Dashboard over a cup of coffee in the morning becomes routine.

Further, we help all the general managers to view the numbers and see where they can improve, versus the owner or the accountant having all the information in systems that the managers don’t have access to. They can view everything on the fly without having to go into the POS system and open 25 files to get a company snapshot.

Additional employee training for operations, chefs, etc is a priority for the foreseeable future. This is where we help drive the performance of our clients’ businesses by being that guide to seeing the numbers.

Tags

Grow Your Restaurant

With our Free Restaurant Success Series

Freely access our restaurant resource center filled with tools, videos, webinars, articles, infographics, and other helpful content to tackle your unique restaurant challenges and grow the business.

What are you waiting for?

Click the button below to learn more.

Related Content

Wrap-Up: Reimagine Your Month-End Close with Sage Intacct

Best Practices to Perfect Your Month-End Close With Sage Intacct

Decoding the Challenges of the Month-End Close

Fast-Track Your Financials: Techniques to Slash Your Month-End Close

Take Control of the Month-End Close: A Checklist for Success

Managing Your Accounts Payable: A Guide for Small Business Owners

© Trusted CFO Solutions.