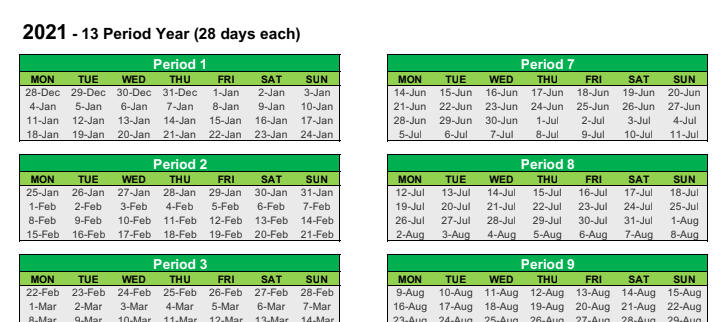

Restaurant 4-Week Periods for 2022 & 2023 + Free Schedule Download

This is part of our Restaurant Success Series. Click here to access other articles.

Now is the time to convert to a 4-week reporting cycle!

The vast majority of restaurants we work with want to use a 4-week period but don’t have their accounting systems set up to make it happen. Usually, the owner or restaurant manager is having to keep these types of schedules manually in Excel. What we hear over and over again is that it isn’t a useful exercise to compare the results of their latest P&L to the previous month because there are usually a different number of days this month than last month. Further, comparing the current month this year to the same month last year may not be valid either!

Most restaurants do 45% to 60% of weekly sales on Friday and Saturday. So, how can you know if you’re actually up 15% this year over last year when this year’s sales may have included 5 weekends?

Monthly P&Ls for restaurants have inherent shortcomings, which is why we convert our restaurant clients to thirteen 4-week periods per year instead of 12 monthly statements.

Need further convincing?

Why Your Restaurant Should Use 4-Week Reporting Periods

- Get Better comparability of your numbers. Operating numbers are more meaningful when compared to budget or prior period(s). On a 4-week cycle, every period P&L reflects the sales and expenses of 4 Mondays, 4 Tuesdays, 4 Wednesdays, and so on. This gives more accurate comparisons for trends of performance; good or bad.

- It’s easier to plan for physical inventories. Months end on different days. One month may end on Friday, and another month may end on a Monday. Which is better for a good, accurate ending inventory value? Obviously, a Friday night isn’t the best for accuracy! No one wants to count ending inventory on a Friday night after a busy shift. Plus, there’s lots of product remaining on the shelf for Saturday. Sunday is generally a slower day, easier to do pre-inventory organization, and inventory is usually at its lowest level of the week… which means less to count.

- It compliments a weekly cycle for the preparation of weekly reports. Weekly prime costs (cost of sales and labor costs) are the best indicator of performance for a restaurant. When you’re calculating food and beverage costs weekly, then you’re on the same physical inventory cycle for your weekly prime cost report and 4-week P&L.

- It may eliminate the need to accrue payroll. The vast majority of restaurants pay their salaried and hourly staff every two weeks. More and more are electing to pay every week. If restaurants pay their staff every two weeks (bi-weekly) and have month-end financial statements, then they must accrue 2 or 3 extra days of payroll in each 30 or 31 day month to show an accurate payroll expense. The 4-week cycle eliminates this accrual. With a 4-week cycle, every P&L will reflect 28 days of actual sales and 28 days of actual payroll.

Our mission is to help improve the performance of our clients’ businesses. The 4-week system is our best practice at Trusted CFO Solutions to make this happen.

The 4-week system helps improve your understanding of how your restaurant is actually performing and is worth considering the switch from calendar month-end to 13 periods per year.

Our clients using this method never consider going back to monthly financials.

Fill Out The Following Form & Download A Complimentary 2022 and 2023 4-Week Printable PDF Schedule For Your Restaurant

For 2022, we provide a 4 week 13-period calendar starting on Monday and one starting on Wednesday.

A 2023 PDF schedule starting on Monday is also available for download.

Tags

Grow Your Restaurant

With our Free Restaurant Success Series

Freely access our restaurant resource center filled with tools, videos, webinars, articles, infographics, and other helpful content to tackle your unique restaurant challenges and grow the business.

What are you waiting for?

Click the button below to learn more.

Related Content

Wrap-Up: Reimagine Your Month-End Close with Sage Intacct

Best Practices to Perfect Your Month-End Close With Sage Intacct

Decoding the Challenges of the Month-End Close

Fast-Track Your Financials: Techniques to Slash Your Month-End Close

Take Control of the Month-End Close: A Checklist for Success

Managing Your Accounts Payable: A Guide for Small Business Owners

© Trusted CFO Solutions.