PP1: Pandemic Business Recovery Commentary From TCFOS Co-Founder Stephen Gross

PROSPER OR PERISH #1. Click here to read past issues.

We’ll be posting on the blog regularly to help our clients and the business community deal with today’s crisis environment.

Here are my insights and reflections on this past week.

Prosper or perish.

Never before in our lifetimes has:

- A pandemic threatened the world with all countries pushing the panic buttons.

- Most global economies have shut down to control the pandemic.

- The devastation that has happened to our economy, and globally is unprecedented.

- The government is attempting to intervene and help businesses survive through this dangerous period.

- With or without government help – the damage has been done, will continue to happen, and the end game is not yet in sight.

All of this represents clear and present danger and must be addressed by us all.

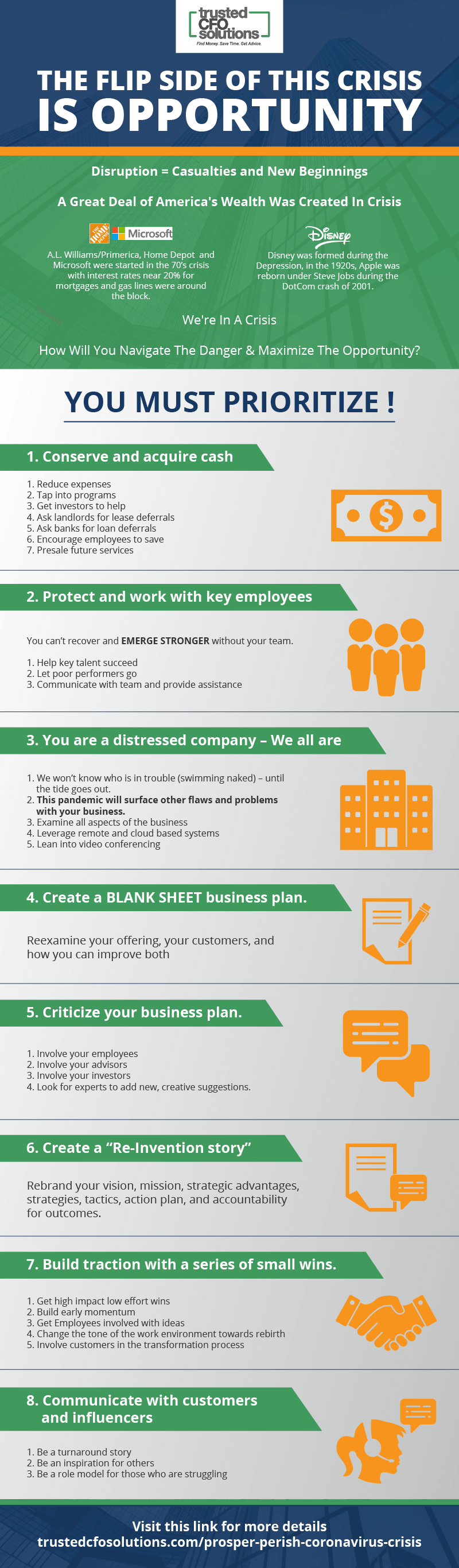

The flip side of this crisis is opportunity:

Disruption in the economy creates casualties and victims. It also is the breeding ground for entrepreneurs and creative businesses. Most of America’s wealth was born and created in volatile times.

A.L. Williams/Primerica, Home Depot and Microsoft were started in the 70’s crisis with interest rates near 20% for mortgages and gas lines were around the block.

Disney was formed during the Depression, in the 1920s, Apple was reborn under Steve Jobs during the DotCom crash of 2001.

So today we find ourselves in a crisis.

How do we navigate through the danger and take advantage of opportunities?

You must prioritize

1. Conserve and acquire cash

Cash is the life blood of a business.

- Slow the burn, reduce all expenses possible.

- Access all available programs: SBA 7(a) PPP loans, SBA 7(b) EIDL loans, state programs (access banks, bankers and programs), unemployment help.

- Investors – ask them to help – 1099 applications to 7(a) for personnel classified as independent contractors.

- Ask for lease deferrals from landlords.

- Loan payment deferrals, ask your bank or mortgage lender.

- Employees – stock for cash? Involve them.

- Prepaid services – gift cards – discount on future orders for cash today.

2. Protect and work with key employees

You can’t recover and EMERGE STRONGER without you’re a team.

- Recognize your core talent and work with them to help survive.

- Recognize poor performers and let them go.

- Communicate with the rest of the team and be helpful with programs or assistance (with planning) to help them through this.

3. You are a distressed company – We all are

- We won’t know who is in trouble (swimming naked) – until the tide goes out.

- This pandemic will surface other flaws and problems with your business. Stress usually surfaces aspects of your processes that don’t work well.

- Examine each facet of your business for alternative ways to do things.

- The big lesson being learned is the capabilities and value of remote, cloud-based systems.

- Video conferencing is being used like never before. It’s an alternative to expensive travel.

4. Create a BLANK SHEET business plan.

- Act as if you are starting your business from scratch.

- Re-examine what you do, who are your customers, how you are serving them, and how to improve service.

- Use principal- High Tech- High Touch.

5. Criticize your business plan.

- Involve your employees

- Involve your advisors

- Involve your investors

- Look for experts to add new, creative suggestions.

6. Create a “Re-Invention story”

Rebrand your vision, mission, strategic advantages, strategies, tactics, action plan, and accountability for outcomes.

7. Build traction with a series of small wins.

- Look for low hanging fruit- easy wins.

- Build early momentum.

- Empower employees to contribute ideas and their own commitments.

- Change the tone of the work environment- Survival, rebirth, and success- together.

- Involve customers and team members in your struggle, in a win-win-win strategy.

8. Communicate with customers and influencers

- Everyone loves turnaround/survival/turnaround stories.

- Be an inspiration for others.

- Become a role model for other struggling companies.

Next steps for our BLOG and future video chats and programs:

- Our advice will focus on rescue steps in the short-term.

- We’ll update you as events and programs develop.

- We’re a resource during your campaign for cash.

Click here to download the infographic as a PDF.

About The Author

Stephen Gross, CPA, CGMA, CVA, CFE — EVP of Hegemon Holdings and Co-Founder of Trusted CFO Solutions — is a big picture thinker and connector, with 40 years of rich and diverse experience in the C.P.A., business consulting, and venture capital worlds. Steve was an early adopter and evangelist of cloud-based accounting, as well as the concept of a virtual C.F.O. or Controller as a method of outsourcing the position in small businesses and startups. Learn More About Steve…

Tags

Outgrowing Quickbooks?

Say goodbye to spreadsheet reporting and manual consolidations and start using a cloud-based financial management system.

Related Content

Wrap-Up: Reimagine Your Month-End Close with Sage Intacct

Best Practices to Perfect Your Month-End Close With Sage Intacct

Decoding the Challenges of the Month-End Close

Fast-Track Your Financials: Techniques to Slash Your Month-End Close

Take Control of the Month-End Close: A Checklist for Success

Managing Your Accounts Payable: A Guide for Small Business Owners

© Trusted CFO Solutions.