Entrepreneurs — EMERGE STRONGER from the Coronavirus (COVID-19) Crisis — Here’s How We’re Helping Make That Happen

Whether you have a small, medium, or large-sized business, COVID-19 has impacted it in ways you never imagined.

We are in an unprecedented time.

There are stories of loss, but there are ways to recover, and emerge stronger than before.

What if you decided to embrace the opportunity of assistance from the government to keep your business operating? And, even better, what if the money you borrow through this government-designed plan is later converted to a grant–a grant that is not repayable? Isn’t that good news?

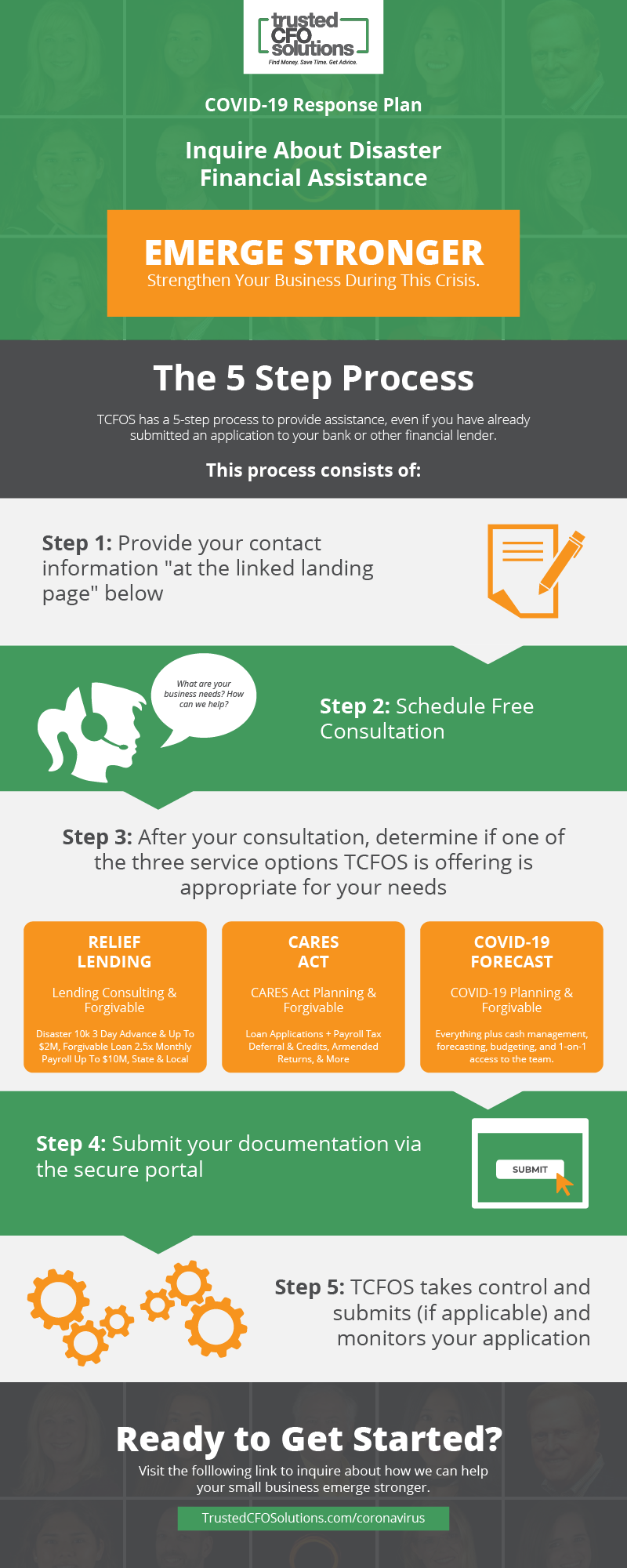

If you are a business owner and have decided to embrace and leverage the responsive opportunities given by the government but need help navigating the process, we at Trusted CFO Solutions are here to help.

Even though there are many wounds and hurdles to jump, there is a way to stop the losses and keep moving. Our government has stepped forward and passed legislation that has many benefits for business owners during this Coronavirus (COVID-19) pandemic.

We at Trusted CFO Solutions have the strategies to help you navigate these and many other processes:

- The Treasury and IRS announced it postponed the April 15 tax-payment for 90 days.

- Take a Reduction in Payroll Taxes for Sick Employees

- What do you need to access up to $2M of the $8,000,000,000+ Direct Cash now available

- Stop the Losses and plan for 2020

- Refundable Payroll Tax Credit for 50% of Wages Paid

We offer consultation services on how to navigate the CARES Act that Trump just signed. This Act includes Payroll Tax Credits, SBA Loans for affected businesses, tax deadline extensions and payment extensions, and now Facebook Ads to grow your business.

Also, we are helping businesses navigate the process of acquiring forgivable and disaster loans from 10K up to 2M. We can help you determine if you are qualified for a three-day turnaround for 10K.

Lastly, we are here to help you gain forgivable or disaster loans from 2.5 times your payroll up to $10M.

Relief is now available in all 50 states so you can start the recovery process and emerge stronger.

Are You Ready to Take The First Step?

Yes, Schedule My Free 30-Minute Consultation

Click here to download this infographic as a PDF.

Help Other Companies Emerge Stronger Using The Following Social Media Graphics

Tags

Outgrowing Quickbooks?

Say goodbye to spreadsheet reporting and manual consolidations and start using a cloud-based financial management system.

Related Content

Wrap-Up: Reimagine Your Month-End Close with Sage Intacct

Best Practices to Perfect Your Month-End Close With Sage Intacct

Decoding the Challenges of the Month-End Close

Fast-Track Your Financials: Techniques to Slash Your Month-End Close

Take Control of the Month-End Close: A Checklist for Success

Managing Your Accounts Payable: A Guide for Small Business Owners

© Trusted CFO Solutions.